-

Reset

+

"Why Toomas Ilves is Right and Paul Krugman Wrong", Postimees, 12 June 2012

12.06.2012

by Anders Åslund

Today, the Estonian government can claim victory. Last year, Estonia's GDP grew by 7.6 percent, the highest growth rate in Europe and high growth continues. All the three Baltic countries have pursued similar economic policies and the results are similarly spectacular. Christine Lagarde, the Managing Director of the International Monetary Fund just presided at a conference in Riga with the title "Against the Odds: lessons from the Recovery in the Baltics."

Professor Paul Krugman, Nobel Laureate in economics, however, denigrates the Estonian achievement with reference to the big output fall of a total of 18 percent in 2008-9. President Toomas Ilves has rightly taken Krugman to task. A Nobel Prize does not mean that you are always right or that you do not need to check the facts.

Krugman's problem is personal. In December 2008, he claimed, "Latvia is the new Argentina." He envisaged that all the three Baltic countries would not recover until they devalued, and now he has been proven wrong, which he refuses to acknowledge. Now he complains that "Estonia has suddenly become the poster child for austerity defenders."

Estonia did not devalue. Instead it carried out a vigorous "internal devaluation," with large cuts in public expenditures and wages as well as structural reforms. Many argue that Estonia is special, but Latvia and Lithuania pursued the same policies and achieved equally good results. These three governments did exactly what they were supposed to do and the Baltic peoples understand that, as evident from the reelection of the Estonian and Latvian governments after the crisis.

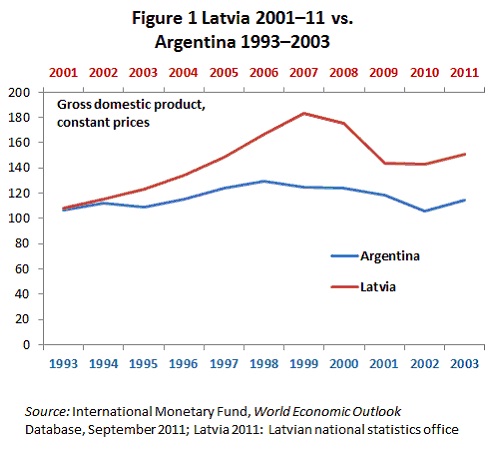

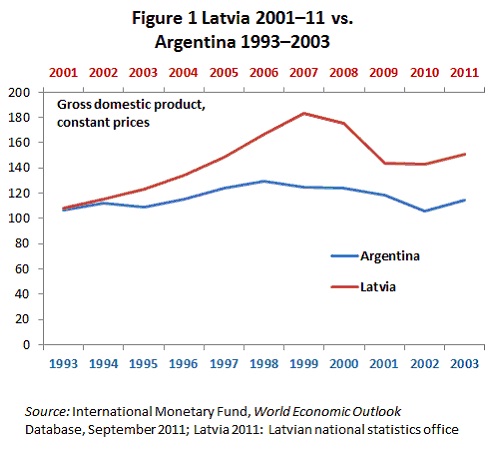

Krugman just looked upon one single graph, without considering causality. His first mistake is that he takes a short period, disregarding the prior high growth rate. His old argument that Argentina shows the benefits of devaluation because of the long and rapid growth afterwards ignores what happened before the crisis. While Argentina enjoyed decent growth, the Baltic countries thrived on an astounding boom. In figure 1, I have compared Latvia in 2000–2011 with Argentina in the corresponding period around its crisis 1992–2003. Latvia had a cumulative growth of 51 percent and Argentina only 15 percent (figure 1).

Second, Krugman ignores the very cause of the Baltic crises, seemingly presuming that it was their austerity programs, but the actual cause was the absence of international credit. On September 15, 2008, when Lehman Brothers went bankrupt, panic grasped global financial markets and the three Baltic countries were cut off from international liquidity, which caused output to plummet. This is the all-dominant cause of the output fall in the Baltics. When output fell, state revenues plunged even more. As a consequence, large budget cuts were necessary to maintain any financial balance.

Thus, the liquidity squeeze caused the output fall that led to falling state revenues and rising budget deficit. Austerity was the consequence of the output fall and not its cause. This is Krugman's crucial mistake. Since Estonia has now joined the euro zone, its banks have access to liquidity from the European Central Bank, so the country will not face such a liquidity freeze again.

Third, in late 2008, the Baltic countries had little choice. Suddenly, they faced large budget deficits that they could not finance. They had to restore confidence in their currencies by doing enough early enough, and they all did. The Baltic countries had no fiscal space and no independent monetary policy, so they could not "stimulate", as Spain and Cyprus bitterly have experienced that they could not either, although then managing director of the IMF Dominique Strauss-Kahn strongly recommended them to do so...

Fourth, Estonia's crisis resolution is also a political economy success story. The Estonian government used the grave sense of crisis in the fall of 2008 to take action. When a country is in a serious crisis, any delay of crisis resolution is harmful. The government composed swiftly a comprehensive anti-crisis program, which was heavily front-loaded, and it explained to the population why this was necessary. Thus the government restored popular confidence early on.

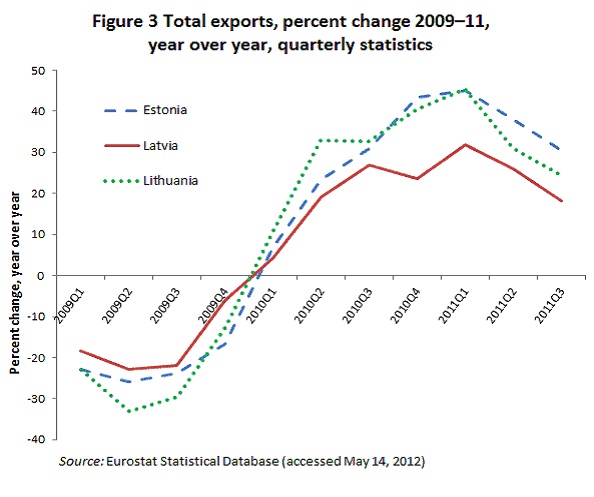

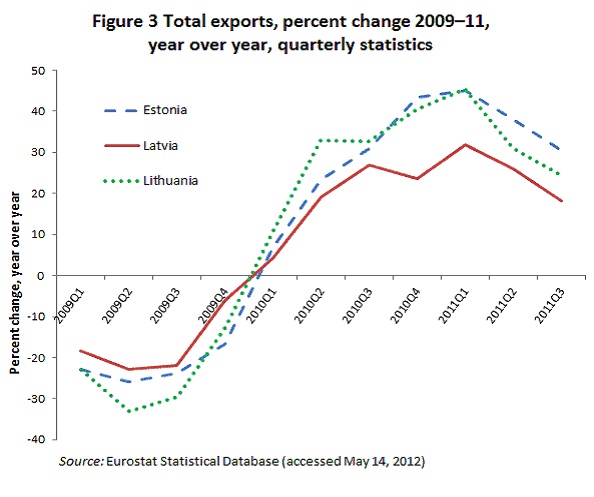

Fifth, one of Krugman's old arguments was that the Baltic states needed to devalue to be able to expand exports, but the Baltic countries, on the contrary, have seen a stunning expansion of exports and manufacturing after the crisis that not even the greatest optimists predicted. Estonia and Lithuania experienced a peak annualized export growth of 45 percent in the first quarter of 2011 (figure 2). Greater expansion would hardly have been possible and certainly not healthy.

A major conclusion is that nominal devaluation has neither been necessary nor beneficial for the regaining of competitiveness. On the contrary, if a country maintains a fixed exchange rate, it is forced to undertake more structural reform, and is more likely to do so. Fixed exchange rates prompted the greatest fiscal and structural adjustments in Central and Eastern Europe.

The crisis resolution of Estonia has proven that internal devaluation is a viable option and probably advantageous. The fixed exchange rates did not impede adjustment but on the contrary facilitated radical adjustment and Estonia's successful adoption of the euro in January 2011.

Indeed, the role of exchange rate regimes seems to be overemphasized. The prominent American macroeconomists Maurice Obstfeld and Kenneth Rogoff have pointed out "the exceedingly weak relationship between the exchange rate and virtually any macroeconomic aggregates." Other policies are simply more important. Therefore, the need even for major cost adjustment is not a reason to leave the euro area.

The governments in Southern Europe could have followed in Estonia's footsteps, but they chose not to. Instead, they pursued the Krugman policy of maximum fiscal stimulus. Today we can see the results of Krugman's policy advice, even if he fails to do so himself. The question is no longer whether the Baltic lessons are relevant to Southern Europe, but when the Southern European governments will face up to reality.

Anders Åslund is a senior fellow at the Peterson Institute for International Economics, Washington, D.C.